This week, Tesla Inc. (TSLA) released its third-quarter vehicle delivery numbers. Since then, there's been no shortage of comments about what Tesla's deliveries mean for the future of the company.

But Tesla's not in trouble here.

In fact, the third-quarter deliveries were off-the-charts good -- and you only need to look at the Chrysler 300 parked in my driveway to prove it.

Thursday, I dropped my Tesla Model S off for its annual service at my local Tesla Service Center.

Like most luxury car brands, it's Tesla's policy to provide customers with loaner cars when they drop off their Model S or Model X.

Here's what Elon Musk had to say about it earlier this year:

"...This will take us a few months to fully deploy, but our policy for service loaners is that the service loaner fleet will be the very best version of a Tesla that is available. So if you have a Model X that comes in for service, the service loaner you will get will be the absolute fully loaded state-of-the-art P100D Ludicrous, best Model X that we have. The same for the Model S."

My loaner car? A Chrysler 300 provided by Hertz (and paid for by Tesla).

Why couldn't Tesla lend me a Model S or Model X? Turns out the Tesla store near me sold all but three of their loaners to customers who couldn't wait the month or so it takes to order a new car -- so they opted to buy an inventory loaner (the quarter-end discounts Tesla has been offering on loaners probably didn't hurt either).

It's a similar case around the country. And that's great for TSLA shareholders.

Don't get me wrong, I'd love to borrow a neck-snapping Model S P100D the next time I bring my car in for maintenance. But the fact that Tesla has been selling off their loaner fleet is a great sign for Tesla shareholders because it means that demand for Model S and Model X remain extremely high.

The most nitpicked number from Tesla's third-quarter production release this week was Tesla's delivery of just 260 Model 3s. Wall Street had been expecting closer to 1,600. The firm blamed temporary production bottlenecks for the shortfall.

On the surface, it looks like a big whiff.

But that's really not how automotive production works. Production scale-ups aren't linear -- they're more like a step function. Like with Model S back in 2012, equipment at Tesla's California car plant and Nevada gigafactory is running at extremely low speeds so that engineers and technicians can catch production snags. Once those snags are worked out, Tesla can more or less turn up the speed on equipment and increase the number of cars it turns out by an order of magnitude.

With that context in mind, the Model 3 production miss looks a whole lot less material.

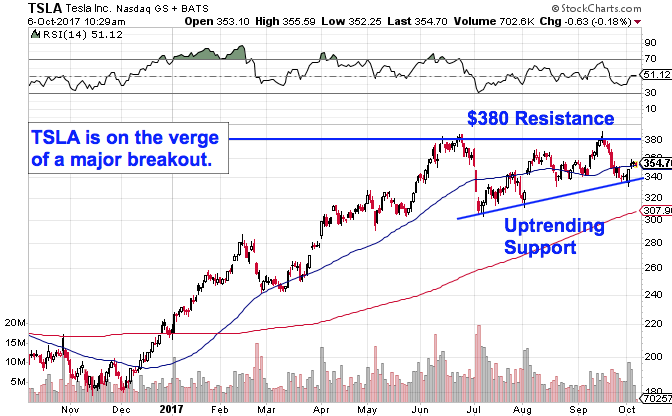

And from a technical standpoint, the price action is confirming a bullish bias to Tesla's chart:

Shares are currently forming a textbook example of an ascending triangle pattern, a bullish continuation setup that indicates more upside ahead. Tesla's setup triggers a new buy on a breakout through $380 resistance, a temporary price ceiling that shares are closing in on this fall. Simply put, a push through $380 signals a second leg higher in TSLA and new all-time highs.

There's still considerable upside in this stock for 2017.

Don't miss these top stories on TheStreet:

Source: Tesla Cars Are Flying off the Lot, Stock Looks Ready to Break Out

No comments:

Post a Comment